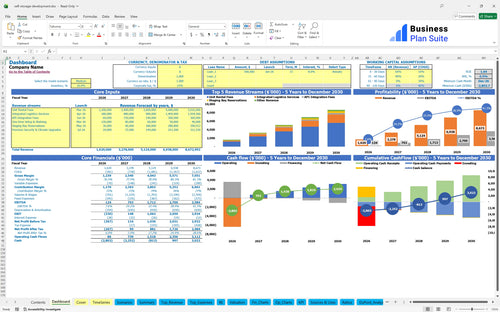

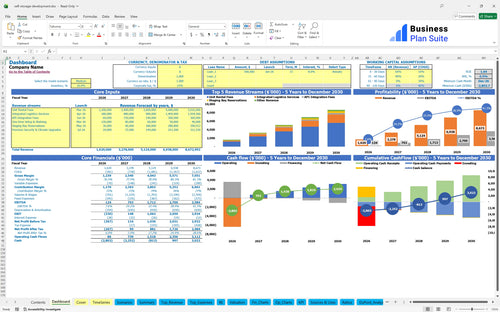

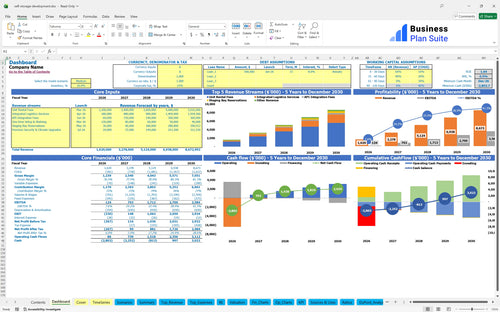

All-in-one Dashboard

Core inputs and core outputs

Your business won't be full on day one. This model accounts for a realistic occupancy ramp-up period and potential seasonal fluctuations in demand. You can easily adjust the assumptions to simulate different scenarios, helping you create a more accurate and resilient financial plan for your e-commerce fulfillment storage or contractor-focused facility.

Core inputs and core outputs

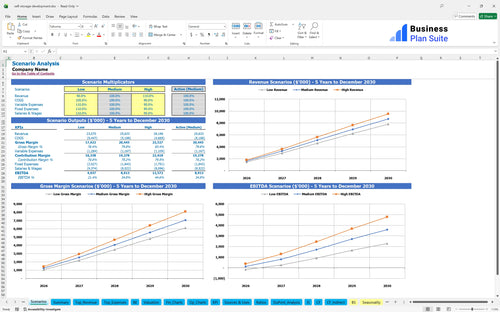

Three scenario analysis

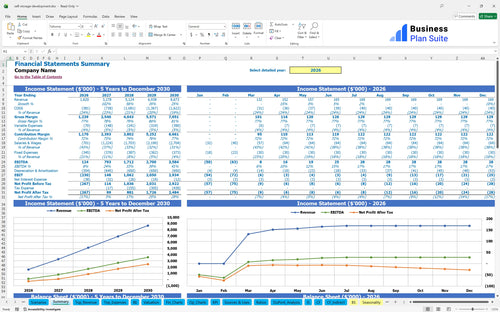

Presentation ready

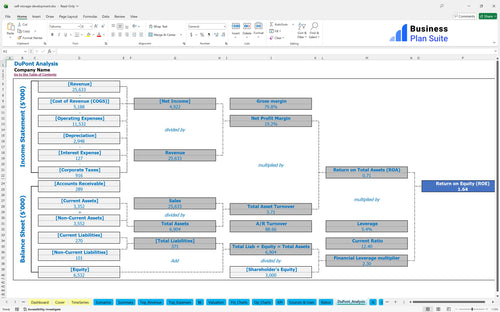

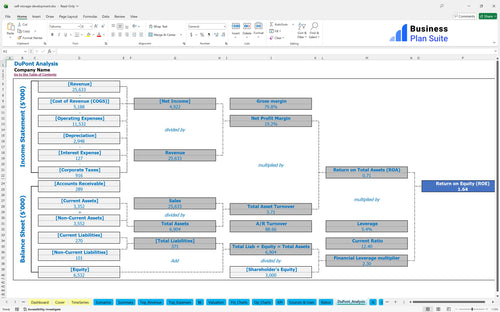

DuPont analysis

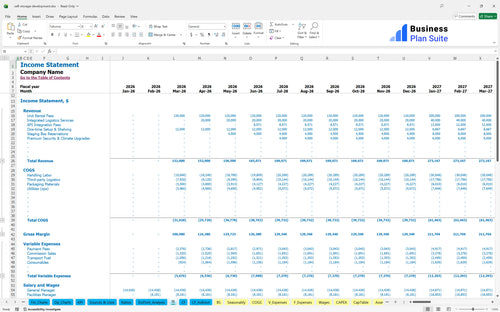

Researched revenue assumptions

Lender-friendly financial outputs

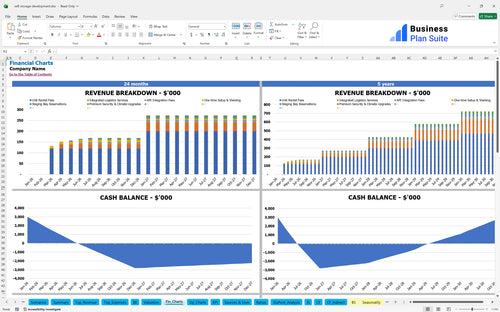

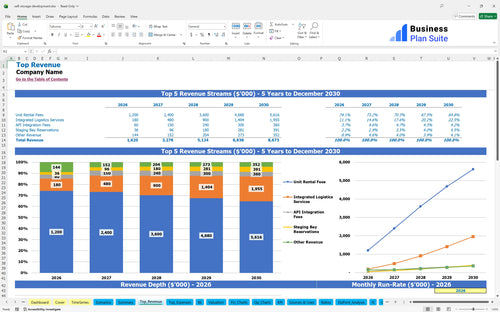

Revenue stream detailed view

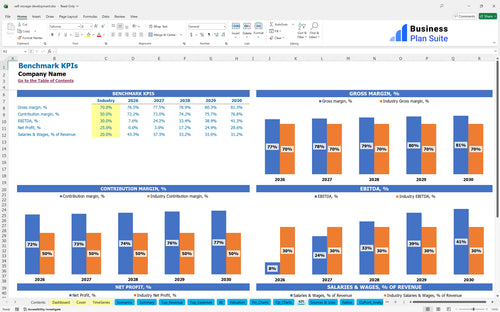

Performance metrics benchmark

We built this self storage development financial model based on our own deep-dive research into the industry. Key assumptions are pre-populated with realistic data but are fully editable to match your unique project. For instance, we've projected initial annual revenue from unit rentals at $1,200,000 and property management fees at $72,000, with a first-year staffing budget of $210,000 to support operations. The initial capital investment is estimated based on specific line items like land and construction costs.

Based on our projections, this business model is profitable from the very first year. After accounting for all operating expenses, debt service, and taxes, the facility is projected to generate a net profit of $231,000 in Year 1. This strong initial performance is driven by a solid occupancy ramp-up plan and controlled operational costs.

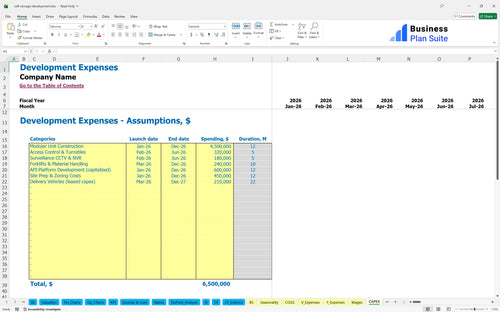

To get this self storage development off the ground, you'll need a total initial investment of $4,700,000. This covers all the major one-time capital expenditures (CAPEX) required to acquire the land, construct the facility, and fit it out with the necessary systems and equipment before you can open your doors to the first customer. This is defintely a capital-intensive venture.

Investors can anticipate a strong return profile from this self storage development plan. The projected Internal Rate of Return (IRR), a key metric for investment viability, is 18.5%. The overall Return on Investment (ROI) is 2.5x, meaning you're projected to get back $2.50 for every dollar invested. The initial capital is expected to be paid back within approximately 5.4 years.

This is a ready-to-use financial model, pre-filled with industry-specific formulas and assumptions for a self storage development. It's designed to be easily tailored to your specific commercial storage business plan, whether you're focusing on traditional units or integrating automated self storage technology. Just plug in your numbers to create a complete financial picture.

You need a clear roadmap for the future, and this model provides just that. It generates detailed 5-year projections for your revenue, costs, and profits, giving you a comprehensive storage facility development plan. This long-term view is critical for securing funding and making strategic decisions about expansion or logistics integration for storage.

Understanding your costs is the first step to managing them. This business plan for self storage breaks down every potential expense, from initial construction to daily operations. You'll get a clear view of where your money is going, helping you manage cash flow and budget effectively for your industrial real estate for storage investment.

When will your facility start making money? This model calculates your break-even point in terms of occupancy rate and total revenue. Knowing this number helps you set realistic targets and understand the occupancy level needed to cover all your fixed and variable costs, which is a core part of any solid self service storage business plan word document.

How does your plan stack up against the competition? The model incorporates key self storage industry trends and benchmarks. This allows you to compare your projected performance on metrics like operating expense ratios and revenue per square foot against established industry standards, ensuring your plan is both ambitious and realistic.

Work where you're most comfortable. This pre-written self storage business plan template word format is also fully compatible with both Microsoft Excel and Google Sheets. This flexibility allows for easy collaboration with your team, advisors, or investors, no matter which platform they prefer to use.

A picture is worth a thousand numbers. The model includes an intuitive dashboard that visualizes your key financial data, from revenue streams to expense breakdowns and profitability trends. These professional charts and graphs make it simple to understand your performance at a glance and present your business plan for automated commercial storage facility to stakeholders.

Your business won't be full on day one. This model accounts for a realistic occupancy ramp-up period and potential seasonal fluctuations in demand. You can easily adjust the assumptions to simulate different scenarios, helping you create a more accurate and resilient financial plan for your e-commerce fulfillment storage or contractor-focused facility.

When you're asking for capital, you need to present a professional and credible plan. This model is formatted to be clear, concise, and investor-ready. It provides all the key financial statements, metrics, and summaries that banks and investors need to see, making it the perfect tool for your investment plan for high-security self storage facility.

Simply purchase and download the financial model template, then access it instantly using Microsoft Excel or Google Sheets. No installation or technical expertise required-just open and start working.

Enter your business-specific numbers, including revenue projections, costs, and investment details. The pre-built formulas will automatically calculate financial insights, saving you time and effort.

Leverage the investor-ready format to confidently showcase your financial projections to banks, franchise representatives, or investors. Impress stakeholders with clear, data-driven insights and professional reports.

Leverage the investor-ready format to confidently present your projections to banks, franchise representatives, or investors.

Typical deployment time varies by site but this template reduces planning delay by giving a complete, editable Word business plan to accelerate permitting and investor materials use the Pre-Written Content and CapEx tables to quickly prepare submissions and avoid costly consultant hours that cause delays.