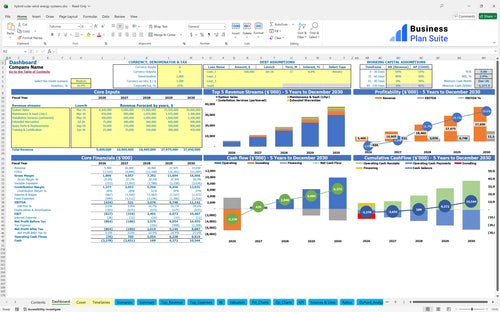

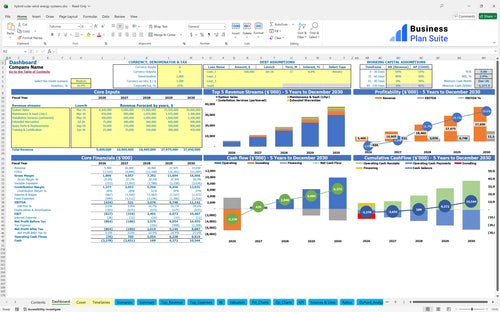

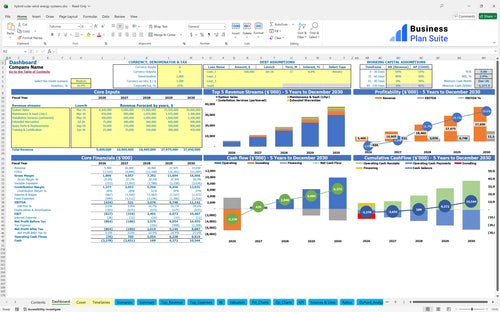

All-in-one Dashboard

Core inputs and core outputs

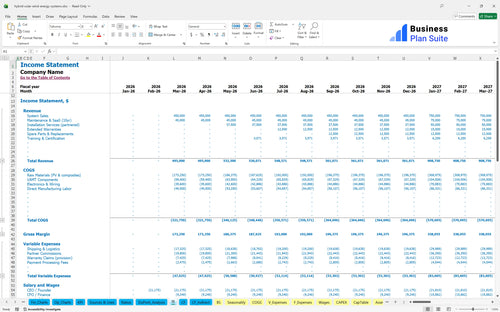

Revenue in the renewable energy sector can fluctuate with the seasons. This financial model allows you to simulate these changes by adjusting your sales and cost assumptions for different months. Planning for seasonality helps you manage cash flow more effectively and ensures your business is prepared for both peak and off-peak periods.

Core inputs and core outputs

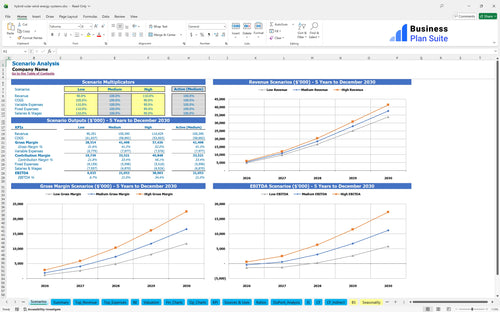

Three scenario analysis

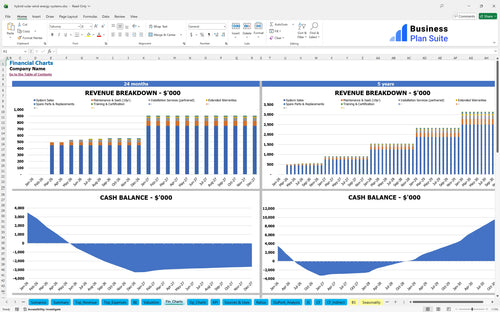

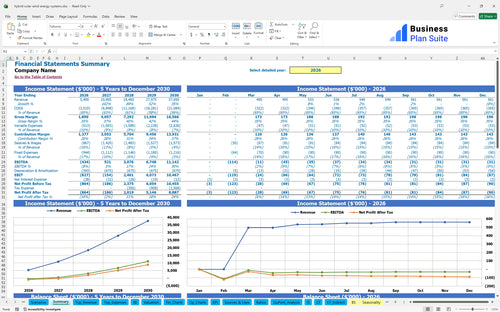

Presentation ready

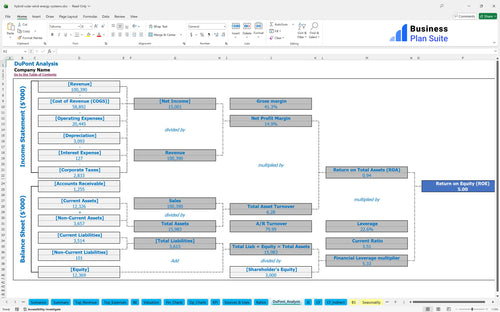

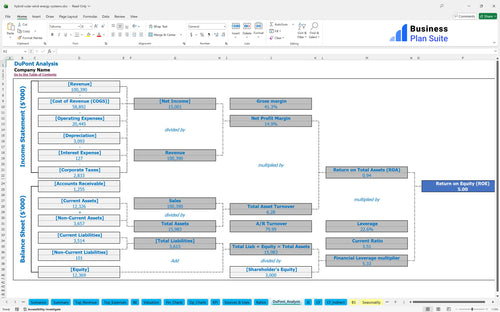

DuPont analysis

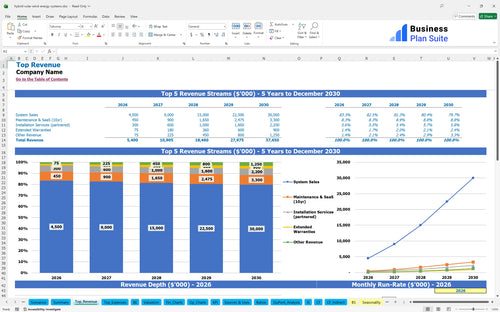

Researched revenue assumptions

Lender-friendly financial outputs

Revenue stream detailed view

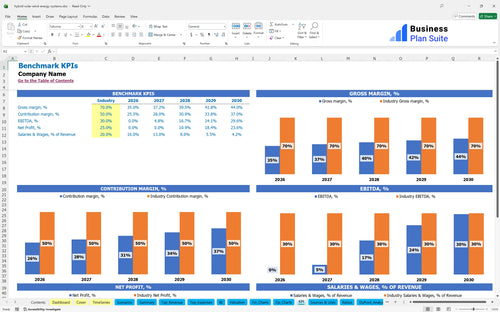

Performance metrics benchmark

We built this hybrid solar wind energy systems financial model based on extensive industry research to give you a credible starting point. Key assumptions-like an average of 20 system sales per month at a $15,000 price point and initial capital investments of $310,000-are pre-populated with realistic data. All inputs for revenue streams, operating expenses, staffing, and capital expenditures (CAPEX) are fully editable to match your specific business plan.

You can expect to reach profitability quickly. Based on the model's projections, the business covers its total initial investment and operating costs to break even within the first 4 months. By the end of Year 1, the projected net profit is approximately $944,400 after all expenses are paid.

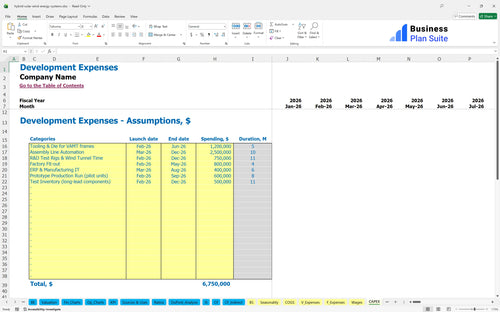

To get this business off the ground, you'll need an initial investment of $310,000. This capital covers all the one-time startup costs required to become fully operational, from securing inventory and vehicles to setting up your warehouse and office.

The financial returns are projected to be very strong. Investors can anticipate an Internal Rate of Return (IRR) of 325% and a 5-year Return on Investment (ROI) of 1985%. The payback period is exceptionally short, with the initial investment recouped in just 0.33 years, or about four months.

This pre-written renewable energy business plan comes with a fully functional financial model, saving you from building complex spreadsheets from scratch. It's pre-filled with industry-specific formulas and assumptions for a commercial hybrid energy systems business plan, making it easy to adapt the numbers to your specific concept. Just plug in your unique figures and the model does the rest.

You need a clear roadmap for the future, and this model provides it with detailed five-year projections. It helps you articulate a credible sustainable energy business model by forecasting revenue, costs, and profits. This long-term view is essential for strategic planning, securing funding, and managing growth effectively in the distributed generation business plan.

Understanding your initial cash burn is critical. This solar wind energy system business plan breaks down all the potential startup costs you'll face when launching. From major equipment purchases to initial inventory, you get a comprehensive list that helps you budget accurately and avoid unexpected financial shortfalls right from the start.

This model automatically calculates your break-even point, showing you exactly how many system sales you need to cover all your costs. Based on our pre-filled assumptions, a typical operation could reach break-even in just 4 months. This analysis is a core part of any hybrid solar wind business plan template, as it defines the threshold for profitability.

How do your numbers stack up against the competition? This model incorporates key performance indicators (KPIs) and financial ratios specific to commercial renewable energy solutions. Comparing your projections for metrics like gross profit margins and sales commissions to industry standards is defintely essential for creating a realistic and competitive microgrid business plan.

Whether you work on a PC, a Mac, or in the cloud, this template is designed for flexibility. It's fully compatible with both Microsoft Excel and Google Sheets, allowing you to work in your preferred environment. This also makes it simple to collaborate with your team, advisors, or investors in real-time, no matter what software they use.

Present your financial story clearly with easy-to-understand charts and graphs. The model includes a visual dashboard that summarizes key financial data, like sales trends and cost breakdowns. These visuals are perfect for making your business case more compelling to investors and for tracking your performance at a glance.

Revenue in the renewable energy sector can fluctuate with the seasons. This financial model allows you to simulate these changes by adjusting your sales and cost assumptions for different months. Planning for seasonality helps you manage cash flow more effectively and ensures your business is prepared for both peak and off-peak periods.

When you're asking for money, you need to look professional. This hybrid solar wind energy system startup guide produces polished, investor-ready reports that clearly communicate your financial plan. The clean formatting and detailed summaries make it an ideal tool for your pitch deck or as a template for renewable energy business proposal word documents.

Simply purchase and download the financial model template, then access it instantly using Microsoft Excel or Google Sheets. No installation or technical expertise required-just open and start working.

Enter your business-specific numbers, including revenue projections, costs, and investment details. The pre-built formulas will automatically calculate financial insights, saving you time and effort.

Leverage the investor-ready format to confidently showcase your financial projections to banks, franchise representatives, or investors. Impress stakeholders with clear, data-driven insights and professional reports.

Leverage the investor-ready format to confidently present your projections to banks, franchise representatives, or investors.

Typical implementation depends on project scale but our template helps accelerate planning by providing a ready-made company description, product overview, and deployment checklists to meet investor/lender standards and credibility it includes the Customizable in Word benefit so you can tailor timelines quickly and avoid time-consuming from-scratch writing, aligning with launch dates in assumptions.