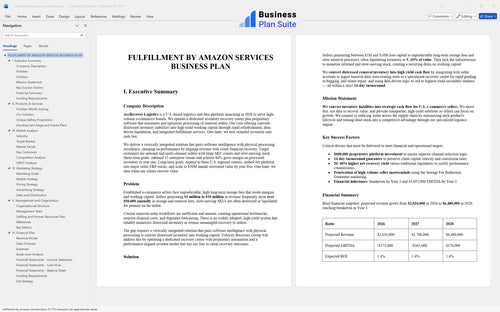

Executive Summary

Your concept at a glance

You get a complete, editable Microsoft Word document containing every section you need to launch your FBA inventory recovery business.

Your concept at a glance

What you sell and why

Market size and rivals

Channels, promotions, conversions

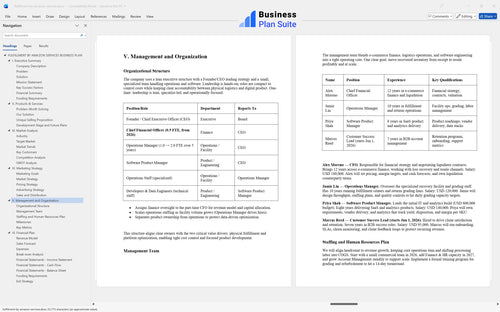

Team roles and org chart

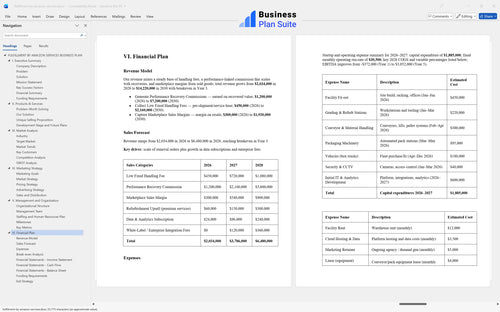

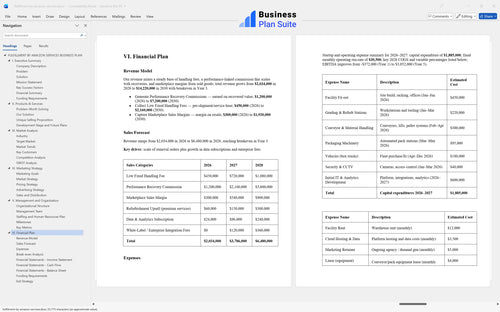

P&L cash flow break-even

We built this FBA liquidation business plan template in Microsoft Word after conducting our own deep-dive research into the market. All chapters are pre-populated with data specific to an FBA inventory recovery service, and everything is fully editable. The included financial model projects revenue growing to $14.22M by the fifth year, giving you a credible, data-backed foundation to build upon.

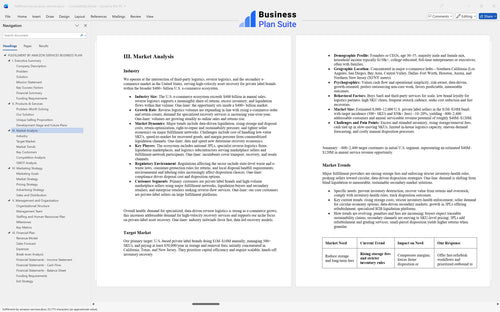

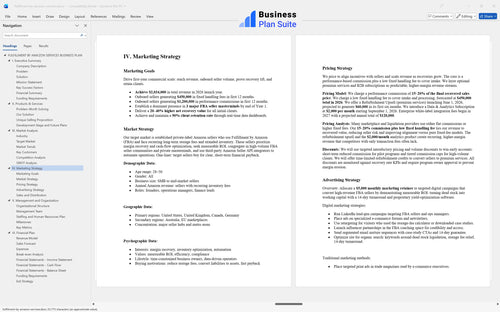

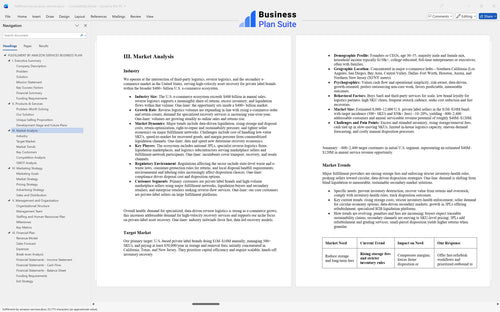

Your ideal customer is an established FBA seller with over $1 million in annual revenue who is getting crushed by long-term storage fees and dead stock. Their core problem is converting this distressed inventory liability back into cash without the hassle of managing a complex, manual removal and liquidation process. Today, they either sell to low-yield bulk liquidators or simply let the inventory expire.

The market is ripe because rising FBA storage fees and increased platform competition are forcing sellers to get smarter about inventory health. Sellers can no longer afford to ignore unproductive assets. This creates a massive, urgent demand for a scalable, hands-off solution that maximizes net recovery value and provides a clear ROI-making this the perfect time to launch an FBA inventory health consulting business plan.

The economics are challenging at first but show a clear path to profitability. Here's the quick math: you're projecting revenue to scale from $2.03M in Year 1 to $14.22M in Year 5. However, the business runs at a loss for the first two years, with negative EBITDA until you hit the breakeven point in Year 3. This is driven by significant upfront capital expenses and high initial operating costs like labor (18%) and buyer payouts (22%). The key is defintely managing those variable costs as you scale volume to achieve the projected $3.05M in EBITDA by Year 5.

This pre-written FBA liquidation business plan word format provides a complete, industry-researched document right out of the box. You get a massive head start because the heavy lifting is already done. You can then easily customize the content to match your specific FBA inventory recovery services, ensuring your final plan is both professional and perfectly aligned with your vision.

Your plan includes a comprehensive financial model with detailed tables for your Profit & Loss, Cash Flow, and Balance Sheet. These projections are built on researched assumptions for an Amazon inventory recovery business plan, giving you a clear view of your path to profitability. This helps you create a solid business plan to reduce FBA long-term storage fees for your clients while managing your own bottom line.

Developing a professional business plan from scratch can be expensive, often requiring thousands of dollars for consultants. This template provides a high-quality, investor-ready document at a fraction of the cost. By using this template for your FBA removal order services business plan, you can save that capital and invest it directly into your operations, technology, or marketing efforts.

You need to present a clear and compelling case to secure funding. This template is designed with investors and lenders in mind, featuring a professional layout, logical structure, and data-driven projections. It helps you articulate your distressed FBA inventory business model confidently, increasing your chances of getting the financial backing you need to launch and scale.

A great business is built on a clear strategy. This template provides a complete framework for defining your company's direction. It includes dedicated sections for your Mission, Vision, Target Market, and Value Proposition, helping you create a cohesive Amazon seller inventory management plan that guides every decision you make.

Understanding the competitive landscape is critical for success. This section provides a thorough analysis of the e-commerce inventory liquidation strategy market, including its size, growth rate, and key trends. It helps you position your FBA inventory recovery services effectively by identifying opportunities and understanding the challenges posed by competitors.

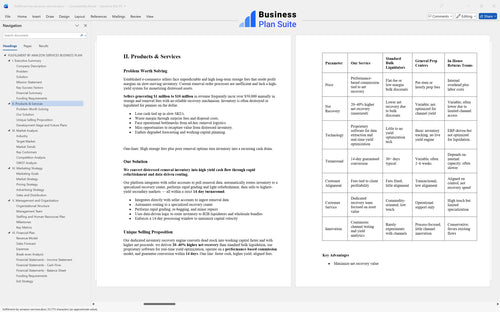

Your plan details how you'll run the business day-to-day. The operations section outlines your inventory processing workflow, staffing needs, facility requirements, and technology stack. It's a practical blueprint for managing an efficient FBA private label inventory liquidation business plan, ensuring you can deliver on your promises to clients from day one.

This template includes a fully developed strategy section to guide your growth. It features a detailed sales and marketing plan to attract high-volume sellers, a SWOT analysis to assess your competitive position, and a 12-month timeline with key milestones. It's your roadmap for acquiring customers and scaling your automated FBA removal order processing business plan.

Your business may attract clients or investors from around the world. To support your global ambitions, this business plan template is available in 115 languages. This feature makes it easier to communicate your vision to international stakeholders, diverse teams, and wholesale FBA returns buyers in different regions.

Purchase the template and download it immediately. Open and edit it seamlessly using Microsoft Word or Google Docs, making it easy to start working on your business plan right away.

Modify each section to align with your business concept, industry, and financial goals. Personalize the content to reflect your target market, unique value proposition, and key financial details.

Leverage the provided example financial projections or seamlessly incorporate your specific figures, utilizing an optional financial model available for purchase.

Conduct a thorough review of your business plan, refining the content to ensure it's investor-ready and serves as an effective operational guide.

It typically meets a 14-day turnaround window from receipt to sale, solving delays that worry investors and lenders by converting liabilities into working capital quickly this template's High-Level Financial Forecasts and Company Description help you document and justify that timeline for credibility and fundraising.